Fascination About Custom Private Equity Asset Managers

Wiki Article

The Best Strategy To Use For Custom Private Equity Asset Managers

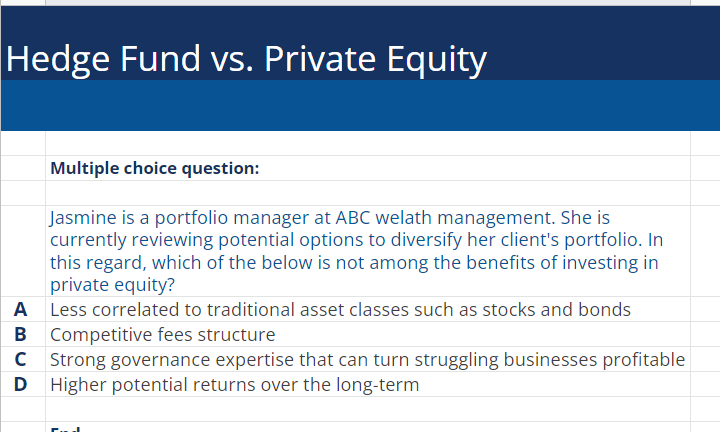

You've possibly come across the term private equity (PE): buying firms that are not openly traded. About $11. 7 trillion in possessions were handled by exclusive markets in 2022. PE companies look for opportunities to gain returns that are better than what can be accomplished in public equity markets. There might be a couple of things you don't recognize regarding the sector.

Private equity firms have an array of investment choices.

Because the most effective gravitate towards the larger offers, the center market is a dramatically underserved market. There are more vendors than there are extremely skilled and well-positioned financing specialists with substantial purchaser networks and sources to take care of a deal. The returns of exclusive equity are generally seen after a few years.

Custom Private Equity Asset Managers for Dummies

Flying below the radar of large multinational companies, a number of these small companies often offer higher-quality client service and/or niche items and solutions that are not being offered by the large empires (https://www.ted.com/profiles/45686886/about). Such upsides bring in the interest of exclusive equity firms, as they possess the insights and wise to make use of such opportunities and take the company to the next degree

Private equity investors need to have trusted, qualified, and dependable administration in location. Many supervisors at profile business are provided equity and benefit payment structures that compensate them for hitting their economic targets. Such positioning of objectives is usually required prior to an offer gets done. Private equity possibilities are frequently out of reach for individuals that can not invest countless dollars, however they should not be.

There are laws, such as limits on the accumulation quantity of cash and on the number of non-accredited financiers. The private equity company draws in a few of the best and brightest in company America, including leading entertainers from Lot of money 500 firms and elite management consulting companies. Law practice can also be recruiting grounds for exclusive equity hires, as accountancy and lawful skills are necessary to total bargains, and purchases are highly my site demanded. https://custom-private-equity-asset-managers-44593031.hubspotpagebuilder.com/custom-private-equity-asset-managers/unlocking-wealth-navigating-private-investment-opportunities-with-custom-private-equity-asset-managers.

The 9-Minute Rule for Custom Private Equity Asset Managers

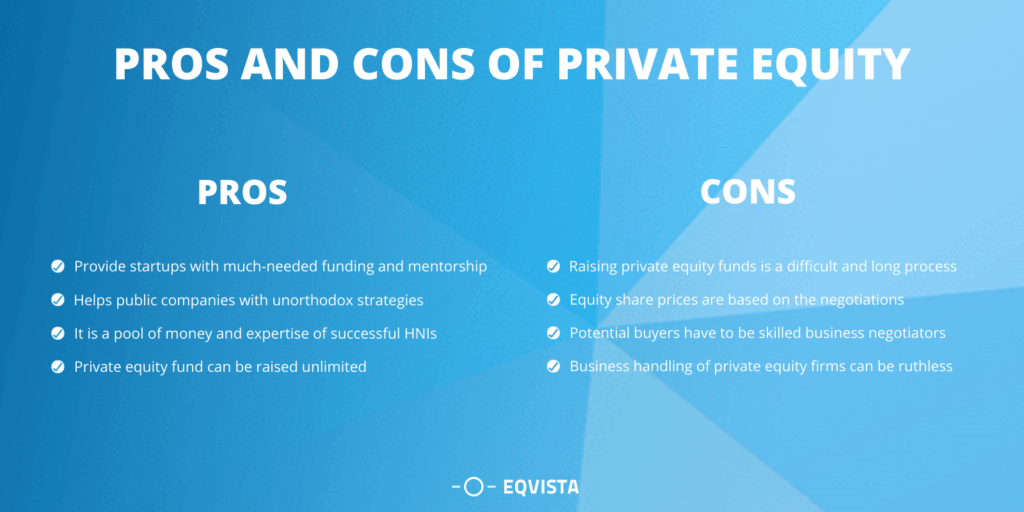

One more downside is the lack of liquidity; when in an exclusive equity deal, it is challenging to get out of or market. There is a lack of versatility. Personal equity also includes high charges. With funds under monitoring currently in the trillions, exclusive equity firms have become attractive financial investment cars for well-off people and institutions.

Currently that access to private equity is opening up to more private investors, the untapped potential is coming to be a fact. We'll begin with the primary debates for spending in exclusive equity: How and why exclusive equity returns have historically been greater than various other assets on a number of degrees, Just how including personal equity in a portfolio affects the risk-return profile, by aiding to expand against market and cyclical danger, Then, we will describe some vital considerations and risks for exclusive equity financiers.

When it involves presenting a brand-new asset right into a portfolio, one of the most basic consideration is the risk-return profile of that asset. Historically, private equity has actually displayed returns comparable to that of Emerging Market Equities and higher than all various other traditional possession classes. Its fairly reduced volatility combined with its high returns makes for an engaging risk-return account.

The Custom Private Equity Asset Managers Diaries

Private equity fund quartiles have the widest variety of returns across all alternate possession classes - as you can see listed below. Technique: Inner rate of return (IRR) spreads calculated for funds within classic years separately and afterwards balanced out. Typical IRR was determined bytaking the standard of the typical IRR for funds within each vintage year.

The effect of including private equity right into a profile is - as always - dependent on the profile itself. A Pantheon study from 2015 suggested that consisting of private equity in a portfolio of pure public equity can open 3.

On the various other hand, the most effective exclusive equity companies have access to an also bigger pool of unidentified opportunities that do not face the same analysis, along with the resources to do due persistance on them and identify which deserve buying (Syndicated Private Equity Opportunities). Investing at the very beginning means higher risk, but also for the companies that do succeed, the fund take advantage of higher returns

9 Easy Facts About Custom Private Equity Asset Managers Explained

Both public and exclusive equity fund managers dedicate to investing a percent of the fund yet there remains a well-trodden problem with lining up interests for public equity fund management: the 'principal-agent problem'. When a capitalist (the 'principal') hires a public fund manager to take control of their funding (as an 'agent') they delegate control to the manager while retaining possession of the possessions.

In the instance of private equity, the General Partner does not simply earn a management charge. Exclusive equity funds likewise minimize another kind of principal-agent issue.

A public equity capitalist ultimately desires one thing - for the monitoring to raise the stock cost and/or pay out returns. The capitalist has little to no control over the choice. We showed over the amount of private equity strategies - especially majority buyouts - take control of the running of the business, ensuring that the long-term worth of the company comes initially, raising the roi over the life of the fund.

Report this wiki page